Mastering Crypto Profit-Taking in a bull market: A Technical Analysis approach

The crypto market is booming ? but don't get caught up in the hype! Learn how to secure your gains with a comprehensive strategy combining technical analysis, market cycle awareness, and investing psychology.

TL;DR: The crypto market is booming, but don't get caught up in the hype! Learn how to secure your gains with a comprehensive strategy combining technical analysis, market cycle awareness, and investing psychology.

Here's the second part on how to optimize profit-taking in a bull market

Analyzing Crypto Market Cycles with On-Chain and Macro Data

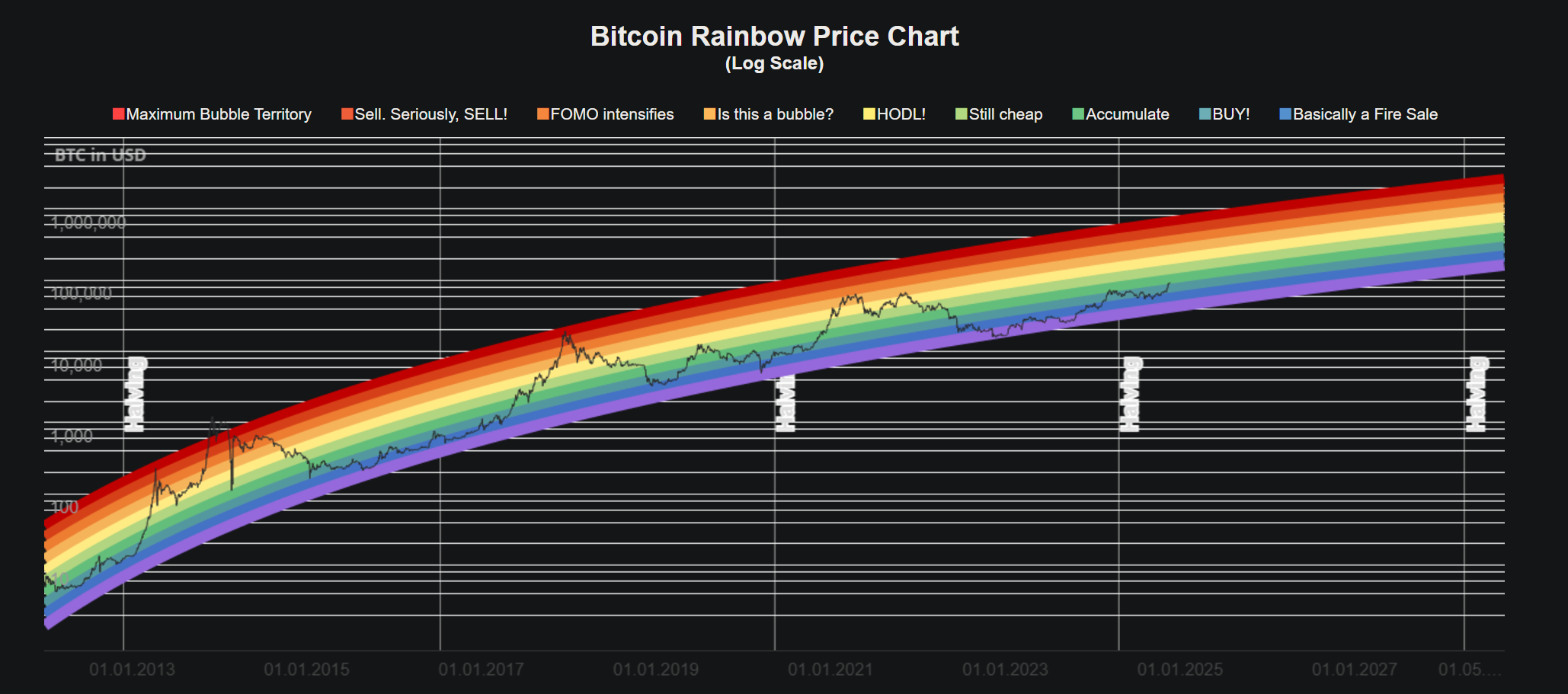

One website I would suggest you to take a look is Blockchain Center, it offers a wealth of useful tools and charts. Tools I recommend are the Bitcoin Rainbow chart as well as the Ethereum Rainbow chart, Flippening index, and Dominance charts among others.

What is the Bitcoin Rainbow Chart?

The Bitcoin Rainbow Chart is a simple way to visualize Bitcoin's long-term price trends. It uses colored bands on a logarithmic scale to show where Bitcoin's price is relative to its historical performance.

Basically:

- Red: Sell! (Possible bubble)

- Yellow: Be cautious (FOMO)

- Green: Good time to hold

- Blue: Buy! (Possible bottom)

It's not perfect, but it can help you:

- See the big picture of Bitcoin's price history.

- Identify potential buying and selling zones.

Other valuable resources:

- Bitcoin Magazine Pro (formerly LookIntoBitcoin): Offers valuable on-chain indicators like the MVRV Z-Score and Pi Cycle Top Indicator.

- Santiment.net: Provides useful on-chain, social, and development data for crypto analysis.

- Unyx Data: Offers interesting charts and tools for crypto market analysis.

Monitoring Stablecoin Printing: Keep an eye on stablecoin printing, as it indicates the flow of capital into the crypto market. Follow Stablecoin Printer on X (formerly Twitter) or Telegram for updates.

Imagine the crypto market as a boat on the ocean. The MVRV Z-Score is like looking at the boat's position relative to the waves – is it riding high (overvalued) or low (undervalued)? Macroeconomic events are like the wind and currents that can push the boat in different directions.

MVRV Z-Score and how to optimize selling

- This is a fancy way to figure out if a cryptocurrency (like Bitcoin) is overvalued or undervalued. It compares the current market value of all coins to their "realized value" (the price people actually paid for them).

- A high Z-Score suggests the crypto is overpriced and might be due for a correction (price drop).

- A low Z-Score suggests it's undervalued and could be a good time to buy.

The impact of macroeconomic events on the crypto market

This means how big events in the world economy affect cryptocurrency prices. Here are some examples:

- Interest Rates: When central banks (like the Federal Reserve in the US) raise interest rates, it can make traditional investments (like bonds) more appealing. This can sometimes lead to people selling crypto and putting their money elsewhere.

- Inflation: High inflation can sometimes make people see crypto as a safe haven asset, like gold. This can drive up demand and prices.

- Regulation: New government rules about crypto can cause uncertainty and volatility in the market. Positive regulations can boost confidence, while negative ones can cause prices to fall.

- Economic Growth: A strong overall economy can make people more willing to invest in riskier assets like crypto.

Using Technical Analysis for Crypto Profit Taking

Maximize your profits!

Even if you're not a technical analysis expert, understanding the basics can significantly improve your trading. Here are a few key indicators to get you started:

- Technical Indicators: Indicators like the RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and Bollinger Bands can help you identify overbought and oversold conditions. For example, an RSI reading above 80% often suggests an asset is overvalued, signaling a potential selling opportunity.

- Moving Averages: Moving averages (MA) help you identify trends in the market. A simple strategy is to sell a portion of your position when the price crosses below a long-term moving average, such as the 50-day MA. This can help you lock in profits and reduce potential losses (Moving averages lessons).

- Fibonacci Retracement: Fibonacci retracement levels, particularly 1.618, 2.618, and 3.618, can be used to identify potential support and resistance zones. These levels become especially relevant after an asset reaches a new all-time high (ATH). Consider taking partial profits when the price reaches these levels. I recommend Babypips in general as accessible resources.

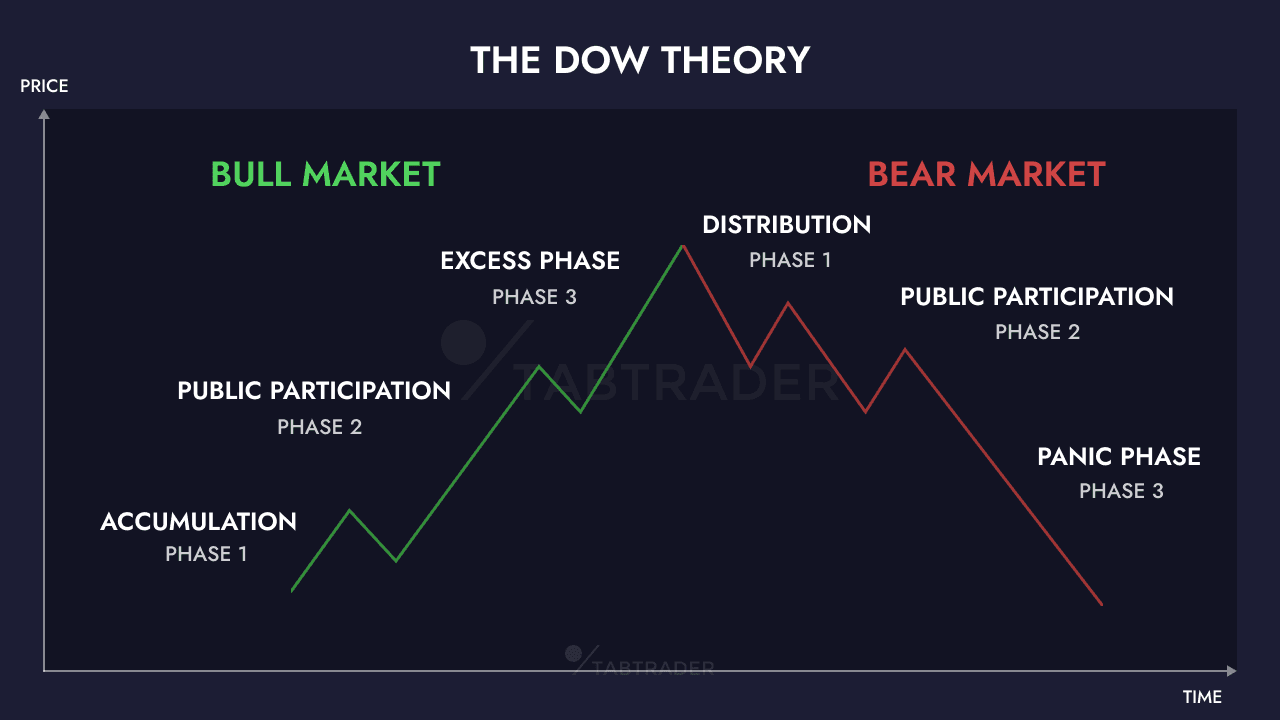

Understanding Crypto Market Cycles and Dow Theory

The complete guide

Dow Theory is a way of understanding stock market trends, developed by Charles Dow. It says the market moves in three trends:

Dow Theory

- Primary: The long-term direction (like a tide).

- Secondary: Shorter-term corrections against the primary trend (like waves).

- Minor: Daily fluctuations (like ripples).

To confirm a trend, Dow Theory looks at:

- Multiple averages: Both industrial and transportation stocks should move in the same direction.

- Volume: Volume should increase in the direction of the trend.

Dow Theory helps identify long-term market trends but can be slow to react and is open to interpretation.

Similarities can be observed between the phases of crypto cycles and the phases of Dow Theory:

- Accumulation (Dow) / Beginning of the cycle (Cryptos): After a bear market, savvy investors start accumulating cryptos at low prices.

- Public participation (Dow) / Bull market (Cryptos): Public interest grows, prices rise rapidly, and euphoria sets in.

- Panic (Dow) / End of the cycle / Bear market (Cryptos): The market peaks, followed by a significant correction and a bear market.

Length of crypto market cycles

As Bitcoin is only 15 years old, we know that each full market cycle last 4 years, perhaps it will change but you should definitely take this in account.

4 years crypto cycles: Bitcoin's halving impact

Market cycles based on Bitcoin halving: Bitcoin follows cycles of about 4 years, marked by the halving of the miners' reward (halving).

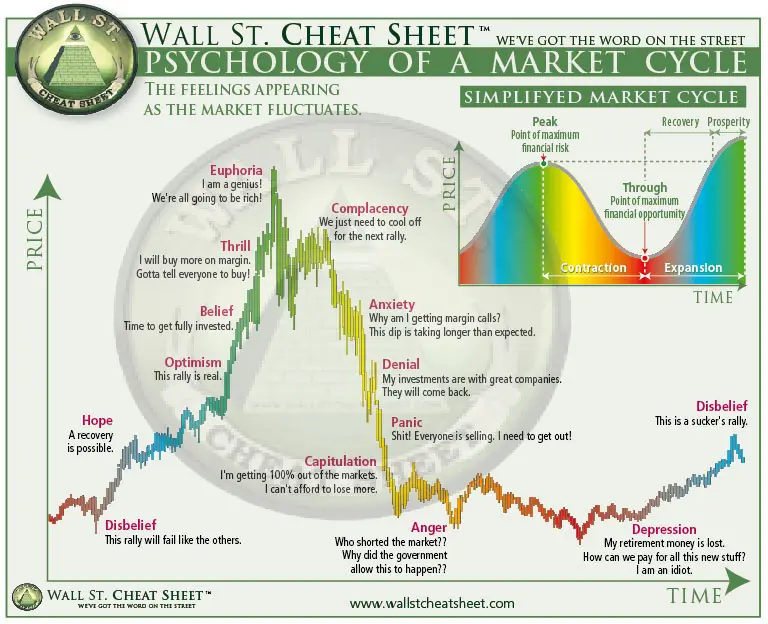

How to identify the Excess Phase of a crypto market cycle:

- Parabolic Price Increases: Prices rise at an accelerated rate, often decoupling from fundamentals. You might see phrases like "to the moon!" and "number go up!" thrown around a lot.

- Extreme Greed and Complacency: Market sentiment indicators show extreme greed. Investors become overly confident, believing the bull market will last forever.

- Overvaluation: On-chain metrics and valuation models suggest that assets are significantly overvalued compared to their underlying utility or intrinsic value.

- Media Hype and Mania: Mainstream media extensively covers crypto, often with sensationalized stories. New investors flood into the market, driven by hype and the fear of missing out.

- Euphoria and Irrational Behavior: Investors ignore risks and blindly chase gains. There's a widespread belief that "this time is different" and that prices will only go up.

75-80% Crypto Correction : the reality of the crypto market

We know that Bitcoin correct of approximately 75% to 80% after making ATH. However, it's performance is more difficult to count as there isn't enough data over the last 15 years.

Keynes's Wisdom to invest in crypto

"Markets can remain irrational longer than you can remain solvent.", John Maynard Keynes.

As a friendly reminder, I've made an introduction about market cycles and emotional behaviors previously.

Your opinion really matters! So if there is any subject you'd like to see here and receive in your mailbox, don't hesitate to reach me from my contact page! I'd be glad to reply and it would be my pleasure if I can help you in your investing.

I've thought about deep diving about the following, your vote is welcome!

And more! so please subscribe and share if you found this article useful, it means a lot for me!

Learn from History: Why Taking Profits in Crypto is Crucial

"Those who cannot remember the past are condemned to repeat it.", George Santayana, The Life of Reason, 1905.

While Solana has proven its reliability over time (Hi SBF!), it's obvious (though I must admit it's easy to say when you're on the left side of the chart).

Don't Fall in Love with Projects

While some crypto projects show promise and may even seem revolutionary, it's crucial to remember that all cryptocurrencies are subject to corrections. Even Bitcoin, the most established cryptocurrency, experiences significant price swings, with corrections of approximately 80% in each cycle. Altcoins often face even steeper declines, sometimes dropping 95% from their all-time highs (ATH).

The Harsh Reality of Crypto: Most Projects Fade Away

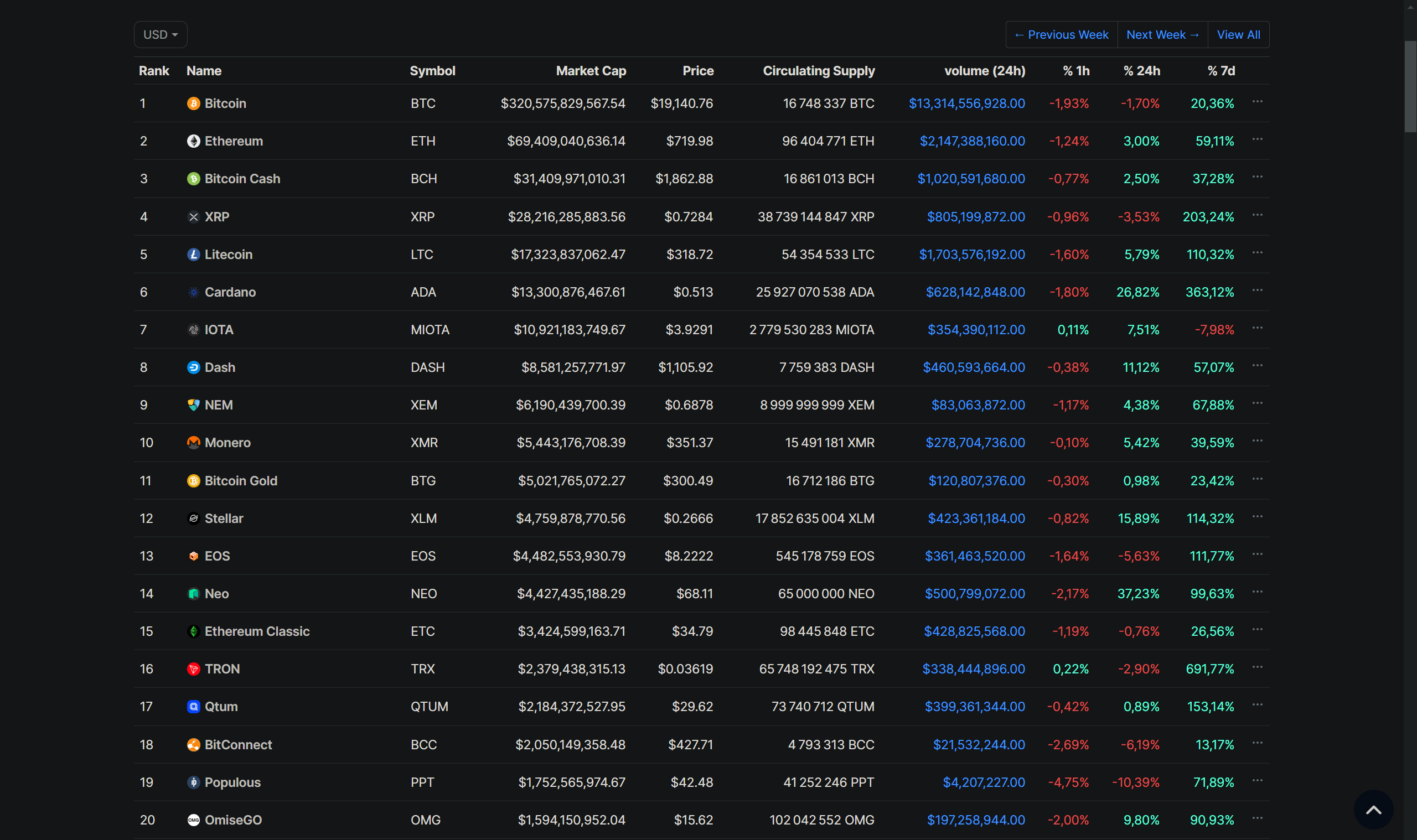

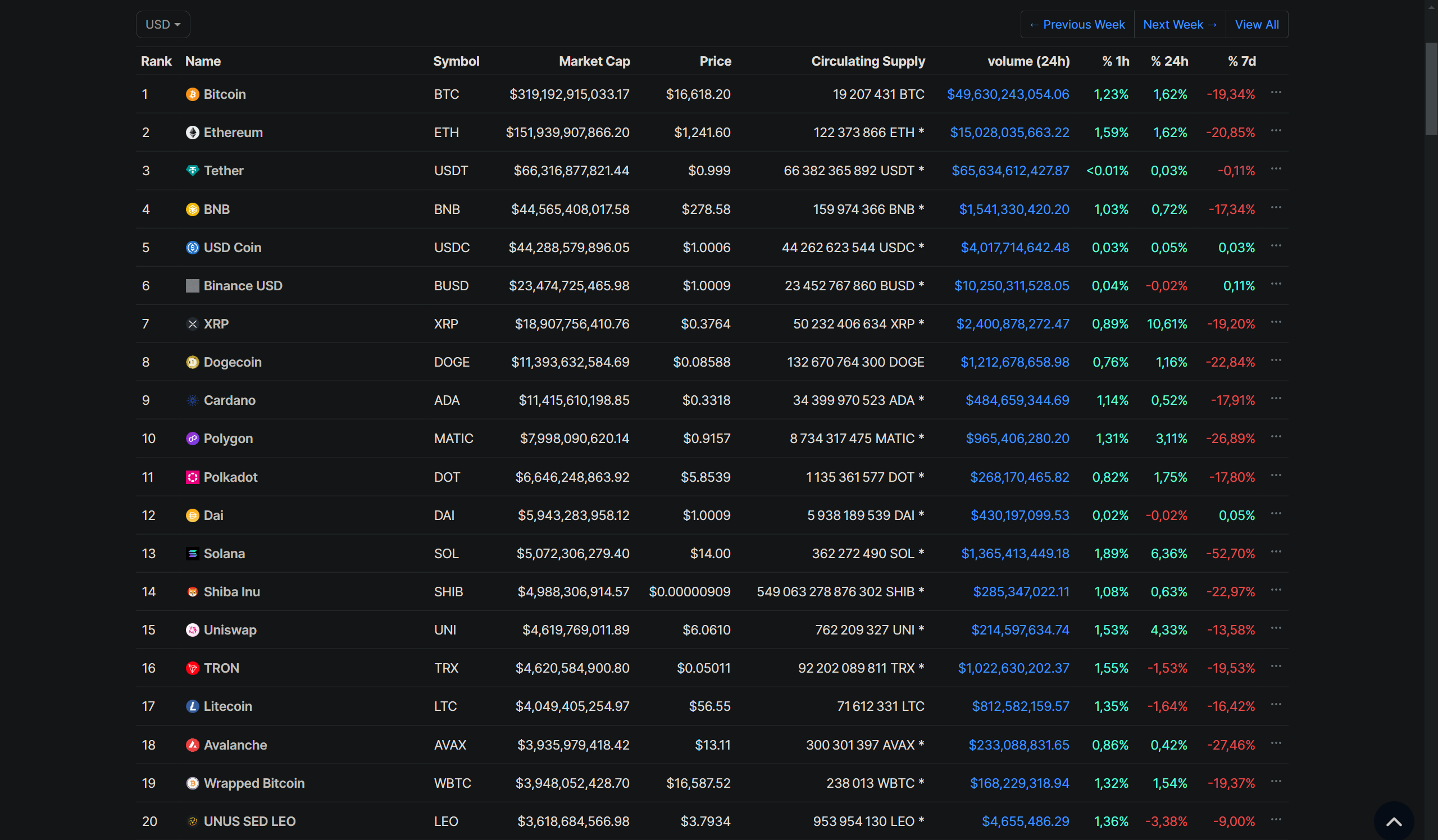

Looking at historical snapshots from CoinMarketCap reveals a stark truth: most crypto projects don't survive. The top 100 cryptocurrencies during a bull market often look vastly different from the top 100 during a bear market. Many projects that once held promise eventually fade into obscurity.

An overview of top 20 crypto during Bitcoin ATH in both 2017 and 2021

If you're fortunate enough to be invested in a crypto project that experiences significant gains, take profits strategically. Don't let emotions cloud your judgment. Sticking to a profit-taking plan can help you secure gains and mitigate potential losses during inevitable market downturns.

As final words, yes it looks like an ad but I'm running another blog with called Yuppie Calls, there I've shared a call that you'll probably not regret to follow 👀

TL;DR: In summary, to maximise your profits in the crypto market, keep these key points in mind:

- Control your emotions: Don't let fear or greed dictate your decisions.

- Establish a solid investment plan and stick to it, even when the market fluctuates.

- Use a combination of tools and indicators: Don't rely on just one indicator.

- Combine technical analysis (RSI, MACD, moving averages, Fibonacci), on-chain data (MVRV Z-Score) and market sentiment analysis to make informed decisions.

- Understand market cycles: Familiarise yourself with the different phases of market cycles (accumulation, bull market, bear market) and learn to identify signals of excess.

- Take profits strategically: Consider a three-step approach: take profits when indicators show overheating, during a market rebound after a correction and hold on to a small portion of your assets (‘moonbag’) to avoid regretting selling too soon.

- Stay informed: Follow the news and macroeconomic events that can influence the crypto market, such as interest rates, inflation and regulation.

- Don't forget crowd psychology: Be aware of the influence of collective emotions on investment decisions and learn to identify cognitive biases.

By applying these tips, you'll be better prepared to navigate the volatile crypto market and maximise.

Key takeaways:

- Be fearful when others are greedy, and greedy when others are fearful.

- Don't fall in love with any single crypto project.

- Take profits when you have the opportunity.

- Learn from the past and adapt your strategy.

Comments ()